Trust Score: 88/100

Based on regulatory status, company history, and financial transparency

- 10+ million clients worldwide across 190+ countries

- Ultra-low $5 minimum deposit on most accounts

- 2026 'Unlimited Cashback' loyalty promotion active

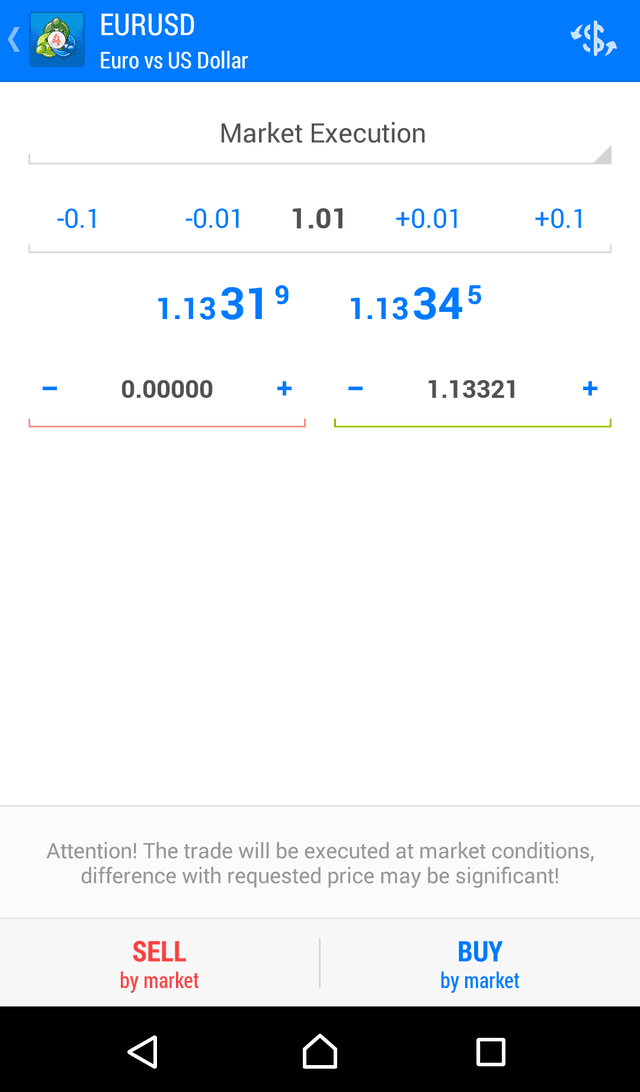

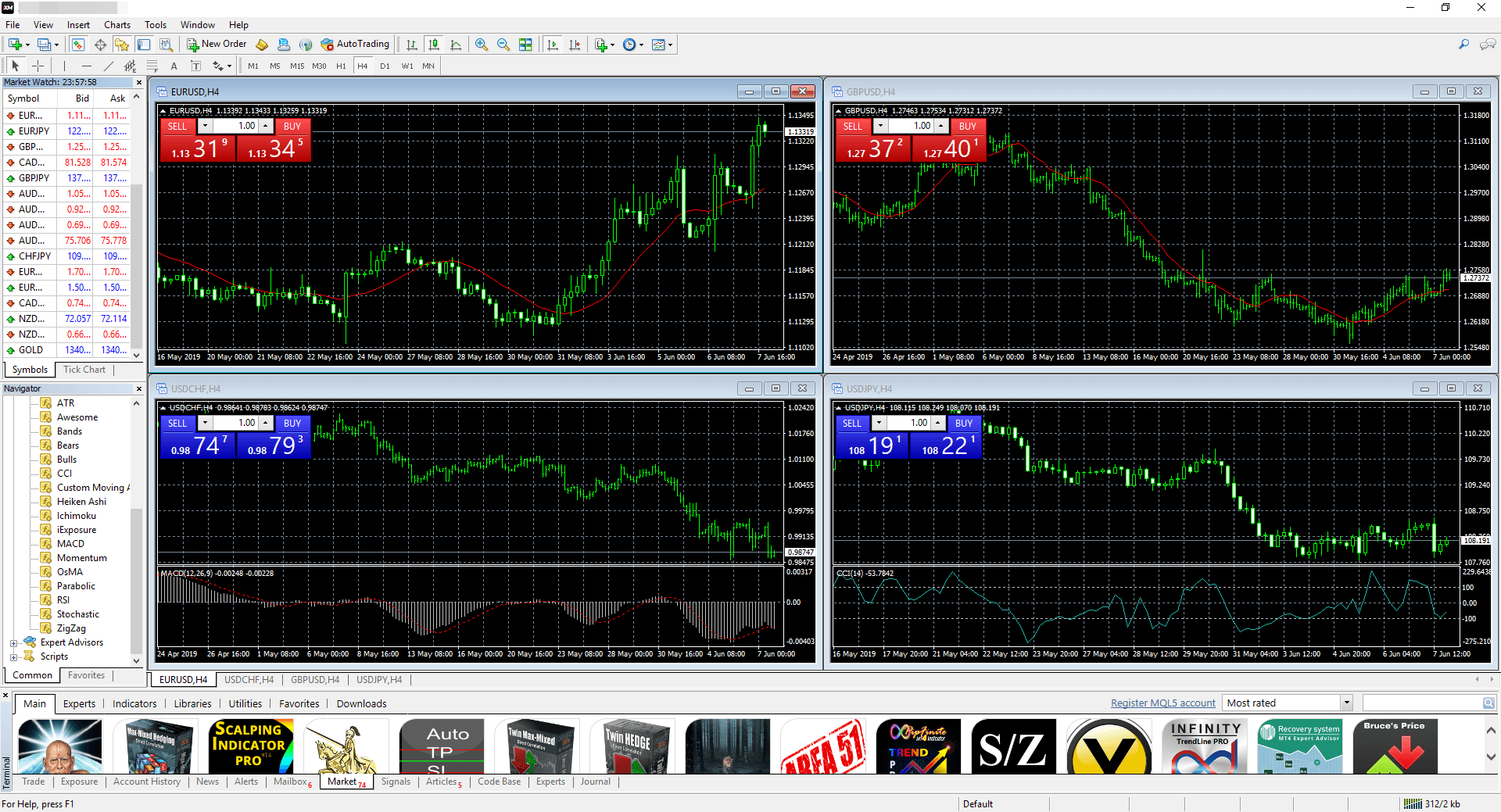

- XM Zero Account: Raw spreads from 0.0 pips

- Ultra Low Account: Spreads from 0.6 pips, no commission

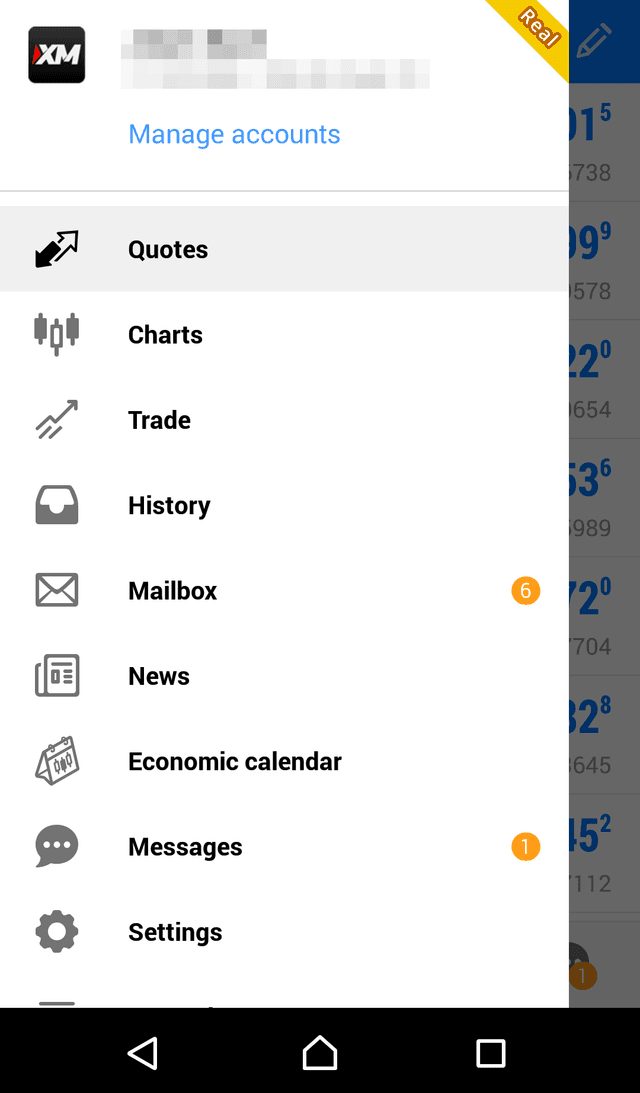

- Regulated by CySEC, ASIC, FSC, DFSA, FSCA (Multi-jurisdictional)

- TradingView integration launched 2026

- 60+ daily live educational webinars in 19 languages

Founded

2009

Headquarters

Limassol, Cyprus

Clients

10,000,000+

Why choose XM

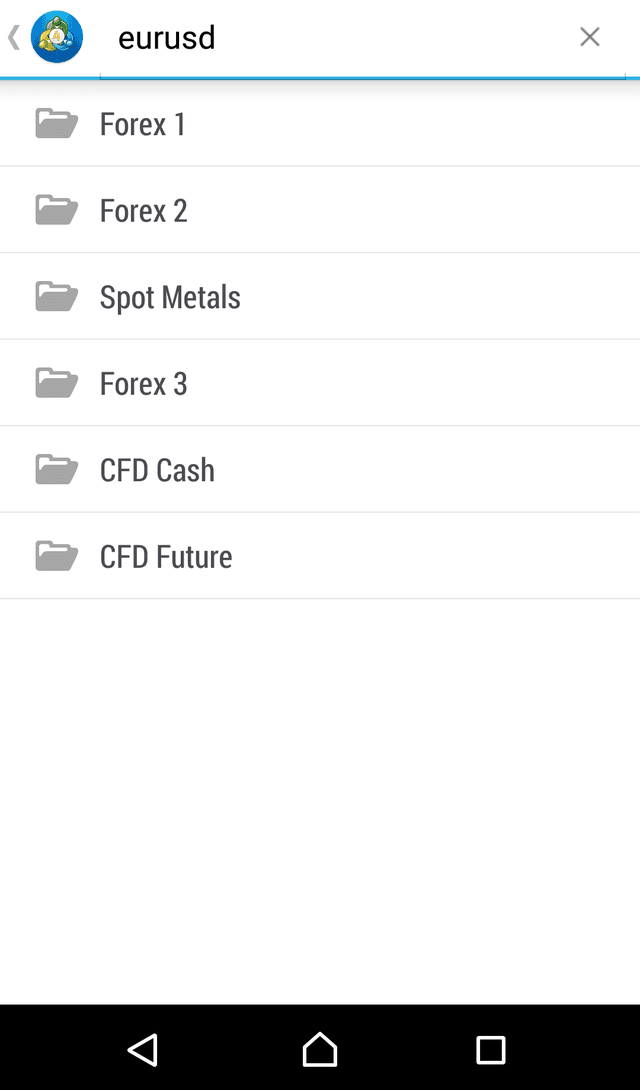

XM is a globally recognized forex and CFD broker that has grown to serve over 10 million clients in 190+ countries since its founding in 2009. As a member of the Trading Point Group, XM has built its reputation on transparency, fair trading conditions, and an exceptional commitment to trader education. The broker stands out for its ultra-low $5 minimum deposit, making it one of the most accessible options for beginner traders. In 2026, XM continues to innovate with its 'Unlimited Cashback' loyalty program, TradingView integration, and over 60 daily live educational webinars in 19 languages. XM emphasizes fast execution with a strict no-requotes policy, claiming 99.35% of orders are executed in under 1 second. The broker offers multiple account types including Micro, Standard, Ultra Low, and XM Zero accounts, catering to traders of all experience levels and trading styles.

Pros

- Very low $5 minimum deposit

- Multiple account types for all levels

- Excellent educational resources (industry-leading)

- Fast execution with no-requotes policy

- No deposit or withdrawal fees

- Free VPS for qualifying traders

- Multi-jurisdictional regulation

Cons

- Not publicly traded - less financial transparency

- No cryptocurrency trading (regulated entities)

- Inactivity fee after 90 days ($15/month then $5/month)

- Standard account spreads wider than competitors