Trust Score: 4.4/100

Based on regulatory status, company history, and financial transparency

- Official Open Sponsor

- High Leverage (Intl)

- IRESS Platform

- Hubx Integration

Founded

2013

Headquarters

Sydney, Australia

Why choose TMGM

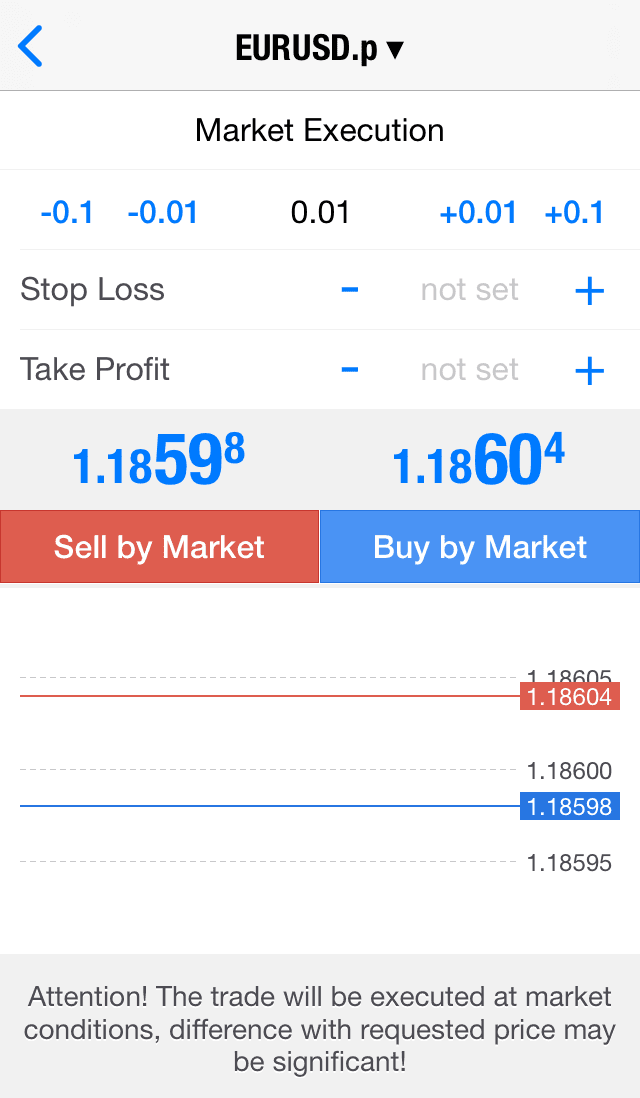

TMGM (Trademax Global Markets) is a high-growth broker known for its lightning-fast execution and prestigious partnership with the Australian Open (2026).

Pros

- Very competitive spreads

- Strong ASIC regulation

- Excellent IRESS platform for stocks

Cons

- IRESS platform has monthly fees

- Education section is basic