Trust Score: 95/100

Based on regulatory status, company history, and financial transparency

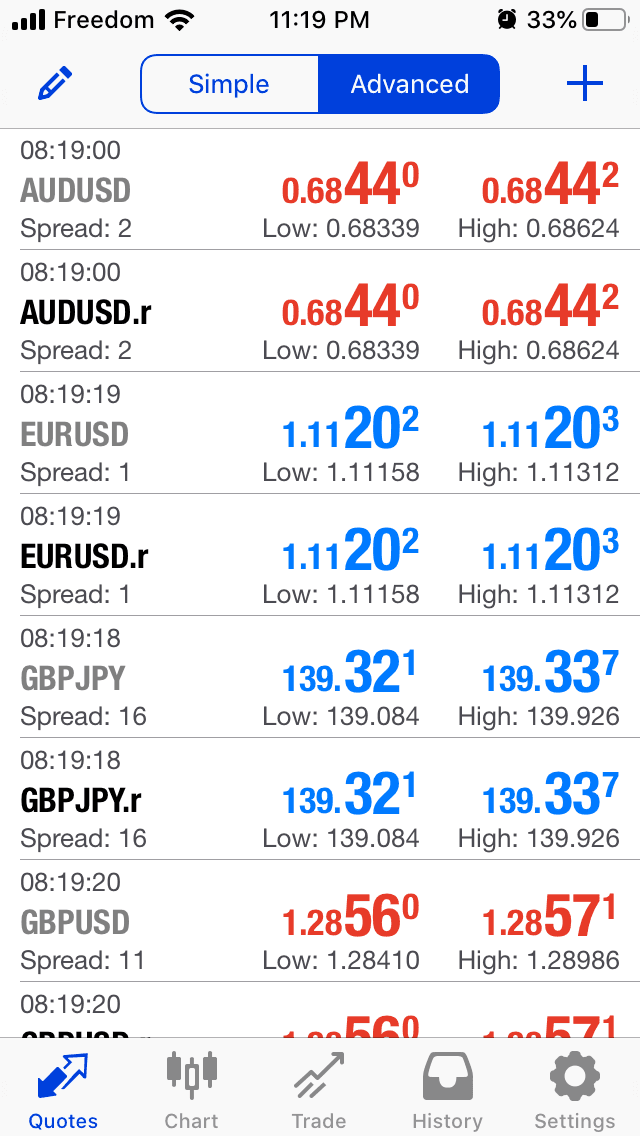

- Razor spreads from 0.0 pips (raw spreads)

- Regulated by 7 jurisdictions (ASIC, FCA, CySEC, BaFin)

- No minimum deposit ($200 recommended)

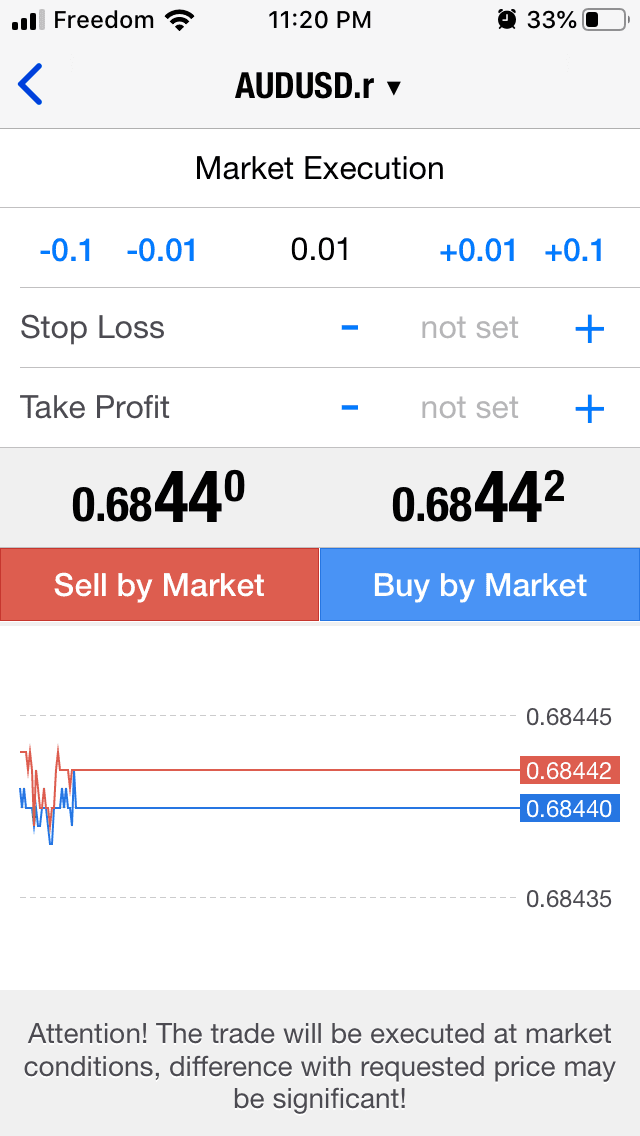

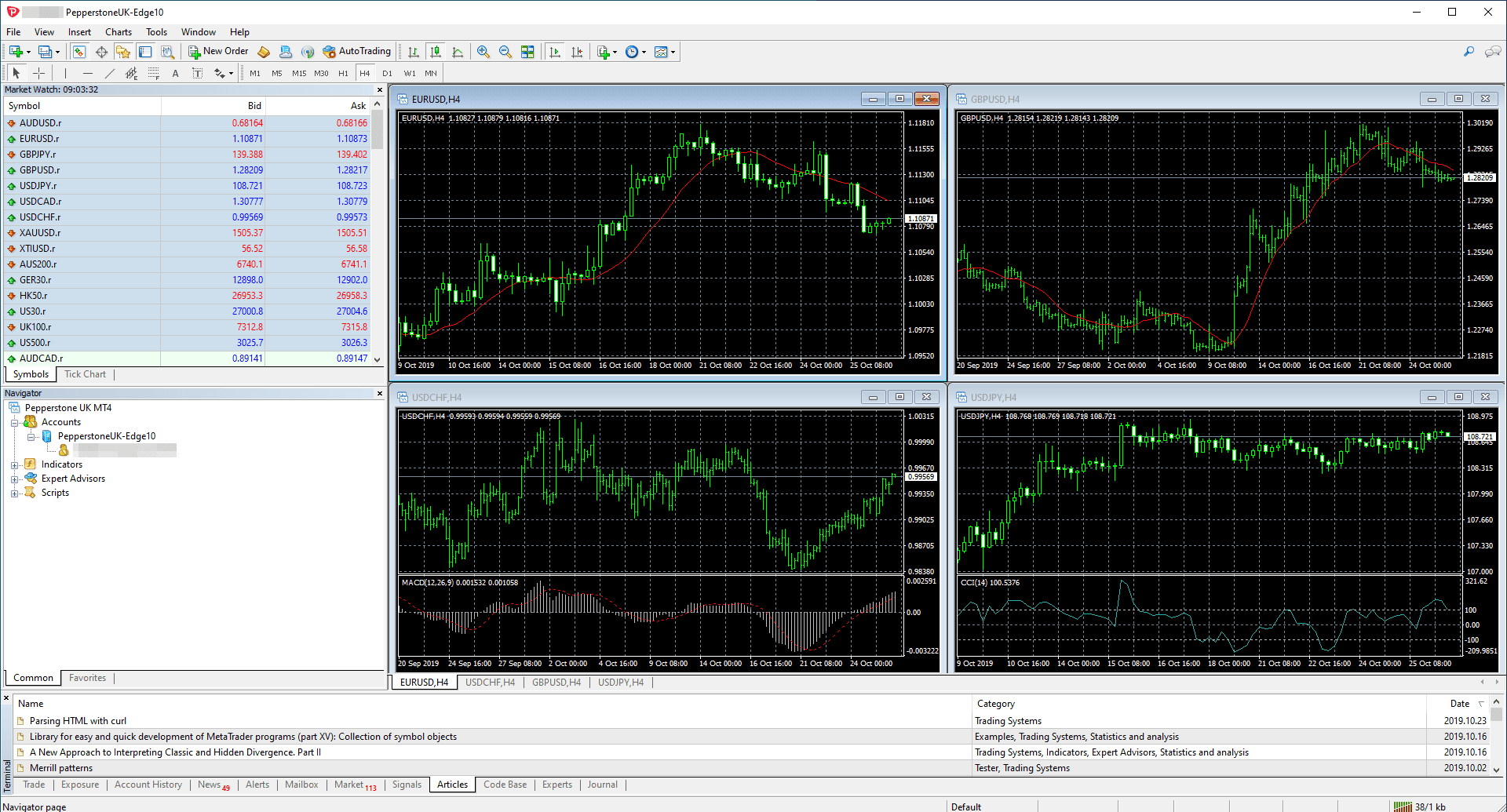

- MT4, MT5, cTrader, TradingView platforms

- Ultra-fast execution for scalpers/algos

- No inactivity fees

- 1,200+ instruments available

- Active Trader rebate program

Founded

2010

Headquarters

Melbourne, Australia

Clients

400,000+

Why choose Pepperstone

Pepperstone is an award-winning Australian forex and CFD broker founded in 2010, renowned for its ultra-tight raw spreads, lightning-fast execution, and exceptional customer service. Regulated by 7 authorities including Tier-1 regulators ASIC (Australia), FCA (UK), CySEC (Cyprus), and BaFin (Germany), Pepperstone serves 400,000+ traders globally. The broker's Razor account offers raw spreads from 0.0 pips with competitive commissions ($7 round turn on MT4/MT5, $6 on cTrader). Pepperstone provides 1,200+ instruments across forex, indices, commodities, shares, and cryptocurrencies. With MT4, MT5, cTrader, and TradingView integration, Pepperstone caters to all trading styles. The broker excels in speed, no deposit fees, no inactivity fees, and free VPS for qualifying traders. Active Trader Program offers cash rebates for high-volume traders.

Pros

- Regulated by 7 jurisdictions including 4 Tier-1

- Ultra-tight raw spreads on Razor (avg 0.1 pips EUR/USD)

- Fast execution - ideal for scalpers/EAs

- MT4, MT5, cTrader, TradingView support

- No inactivity fees, no deposit/withdrawal fees

- Active Trader rebates for high-volume

Cons

- Standard account spreads wider than Razor

- Commission varies by platform

- No proprietary mobile app

- Research less extensive than IG

Pepperstone

Save Wishlist's

Popular choice

Min Deposit: | $0 |

Inactivity Fee: | No |

Regulated: | Yes |