Trust Score: 95/100

Based on regulatory status, company history, and financial transparency

OANDA Score Breakdown

- 28+ years of operation (since 1996)

- Regulated by 6 Tier-1 authorities (NFA, FCA, ASIC, CIRO, MAS, JFSA)

- No minimum deposit requirement

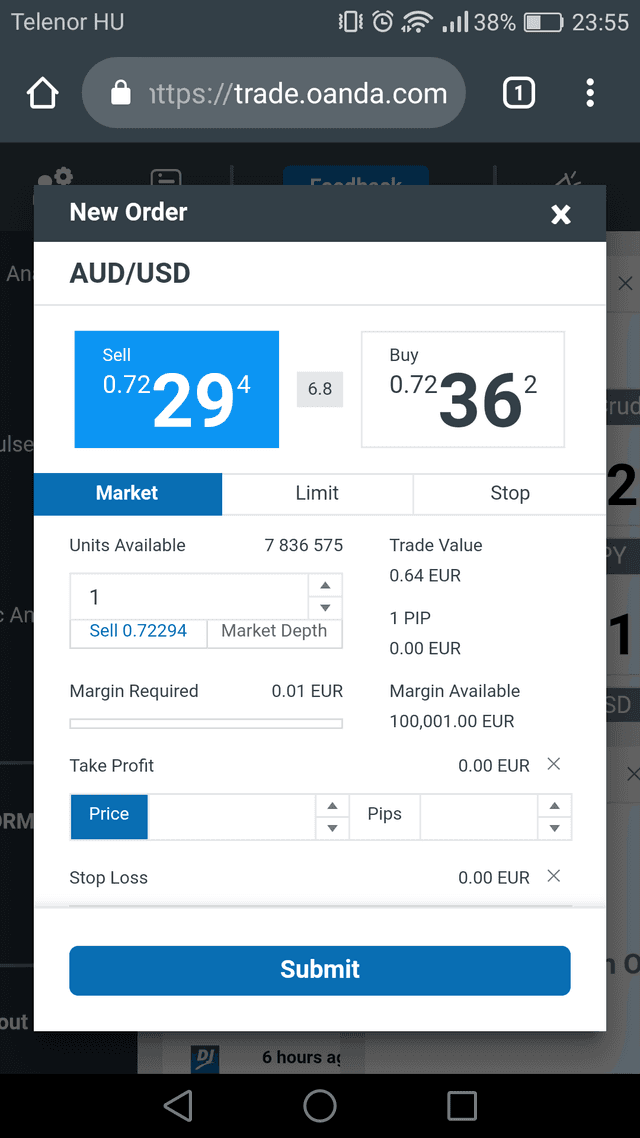

- Award-winning OANDA Trade platform

- TradingView integration available

- Competitive spreads from 0.6 pips

- Available to US traders (NFA regulated)

- Best-in-class mobile app

Founded

1996

Headquarters

New York, USA

Clients

200,000+

Why choose OANDA

OANDA is a pioneering global forex and CFD broker founded in 1996, making it one of the oldest and most trusted names in online trading. Regulated by 6 Tier-1 authorities including NFA (US), FCA (UK), ASIC (Australia), CIRO (Canada), MAS (Singapore), and FSA (Japan), OANDA serves traders in 196+ countries. The broker stands out with its no minimum deposit policy, competitive spreads from 0.6 pips, award-winning OANDA Trade platform, and TradingView integration. OANDA offers 70+ forex pairs plus indices, commodities, bonds, and metals. The company pioneered internet-based currency exchange and provides its proprietary currency data to corporations worldwide. With 28+ years of clean regulatory history, OANDA remains a top choice for US, Canadian, and global traders seeking maximum security and reliability.

Pros

- Regulated by 6 Tier-1 authorities

- 28+ years of clean regulatory history

- No minimum deposit requirement

- Competitive spreads from 0.6 pips

- Award-winning mobile app

- Available to US traders

- Excellent educational resources

Cons

- Inactivity fee after 12 months

- No individual stock CFDs

- Limited cryptocurrency offering

- Higher spreads than some ECN brokers