Trust Score: 4.2/100

Based on regulatory status, company history, and financial transparency

- $2.25 Commission

- No Minimum Deposit

- Low Costs

- Fusion+

Founded

2017

Headquarters

Melbourne, Australia

Why choose Fusion Markets

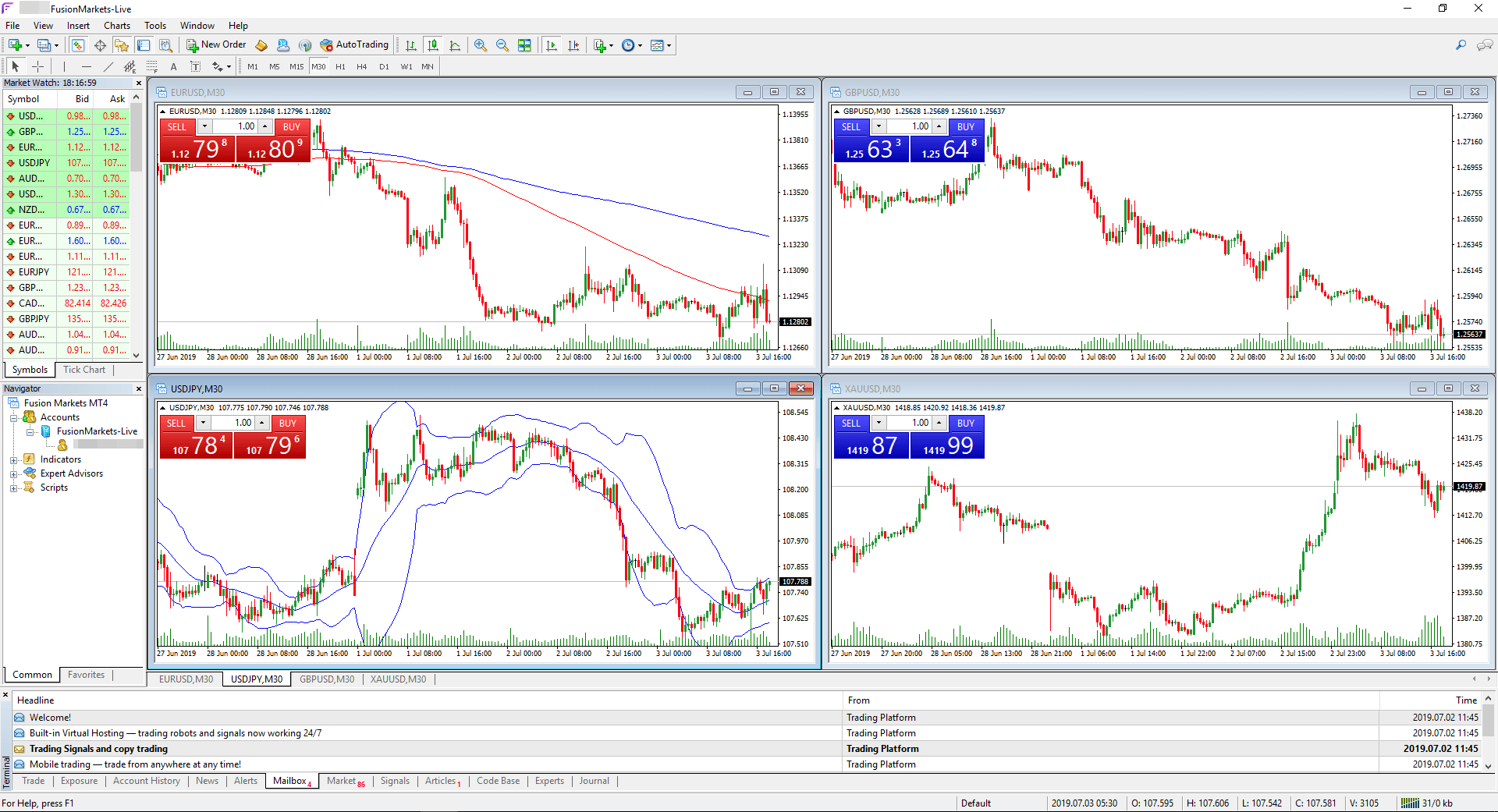

Fusion Markets is a discount broker committed to radically lower trading costs. It continues to offer the lowest advertised commission in the industry as of 2026.

Pros

- Cheapest commissions globally

- No minimum deposit

- Good copy trading system

Cons

- Education is minimal

- Research tools are basic

Fusion Markets

Save Wishlist's

Popular choice

Min Deposit: | $0 |

Inactivity Fee: | No |

Regulated: | Yes |