Trust Score: 90/100

Based on regulatory status, company history, and financial transparency

- 35+ million registered users worldwide

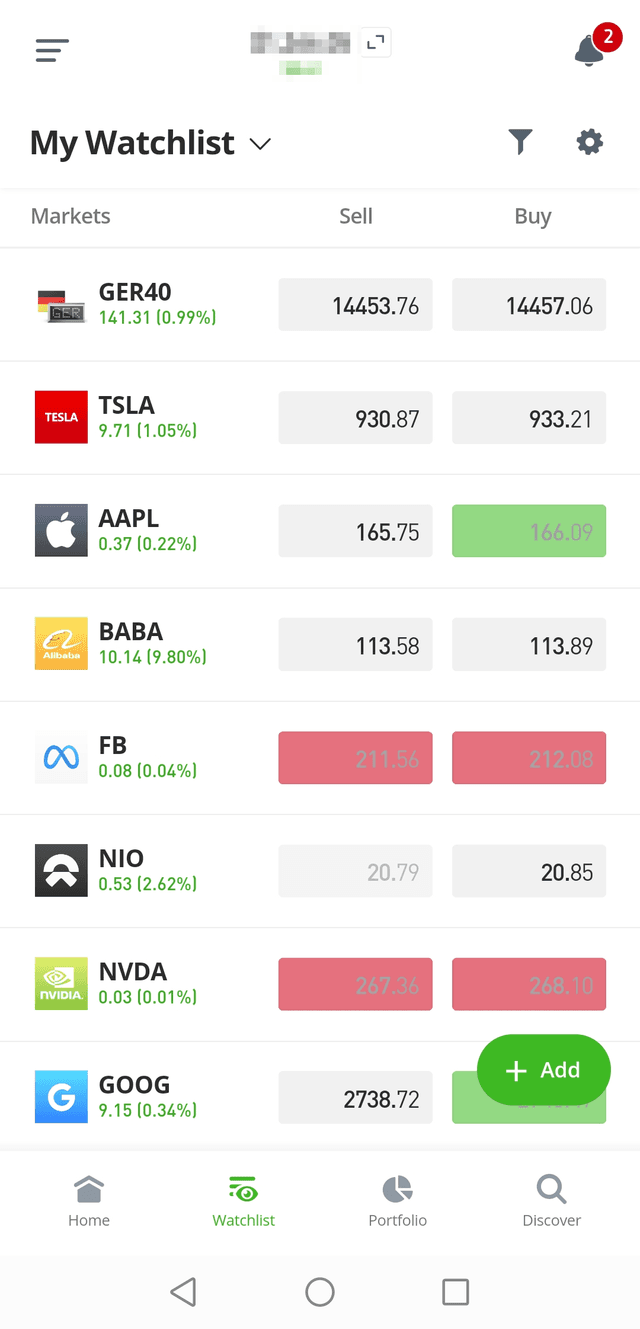

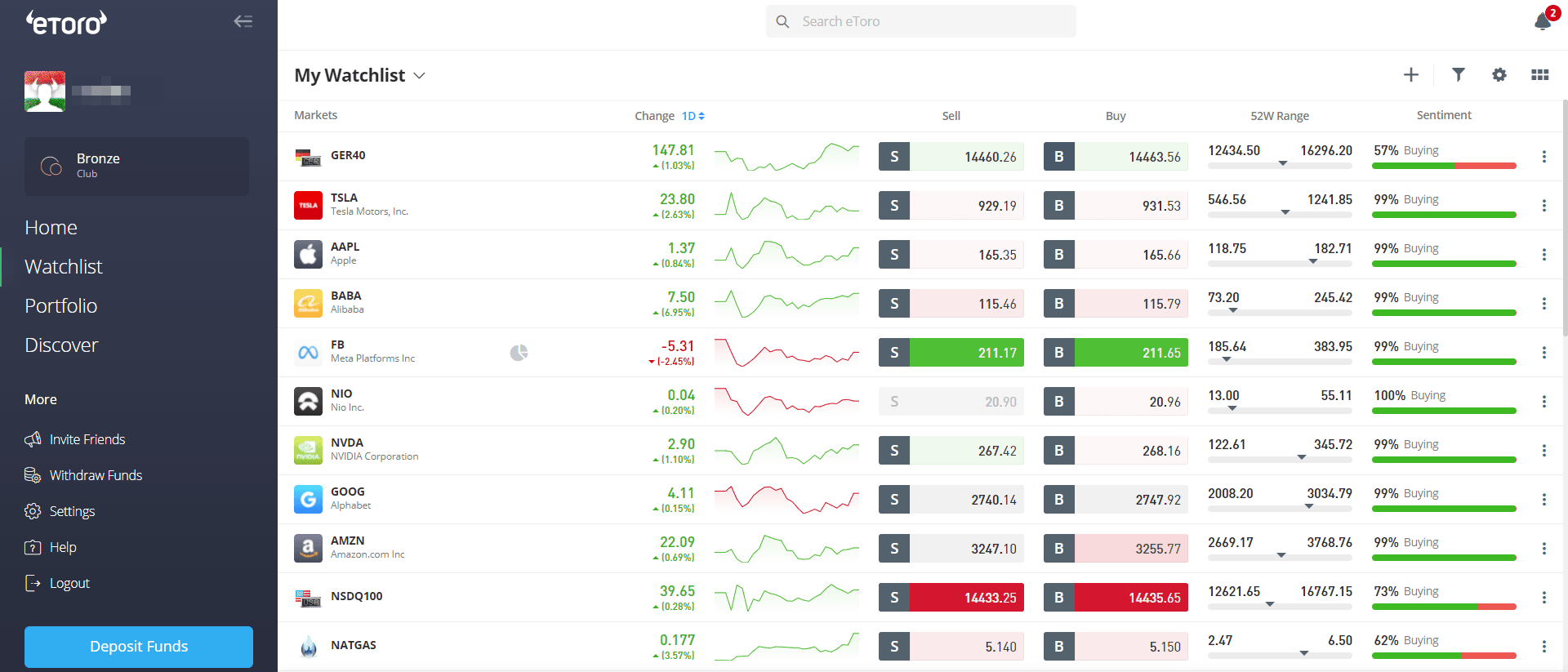

- World's #1 Social Trading Platform (CopyTrader™)

- Commission-free stocks and ETFs (UK/EU)

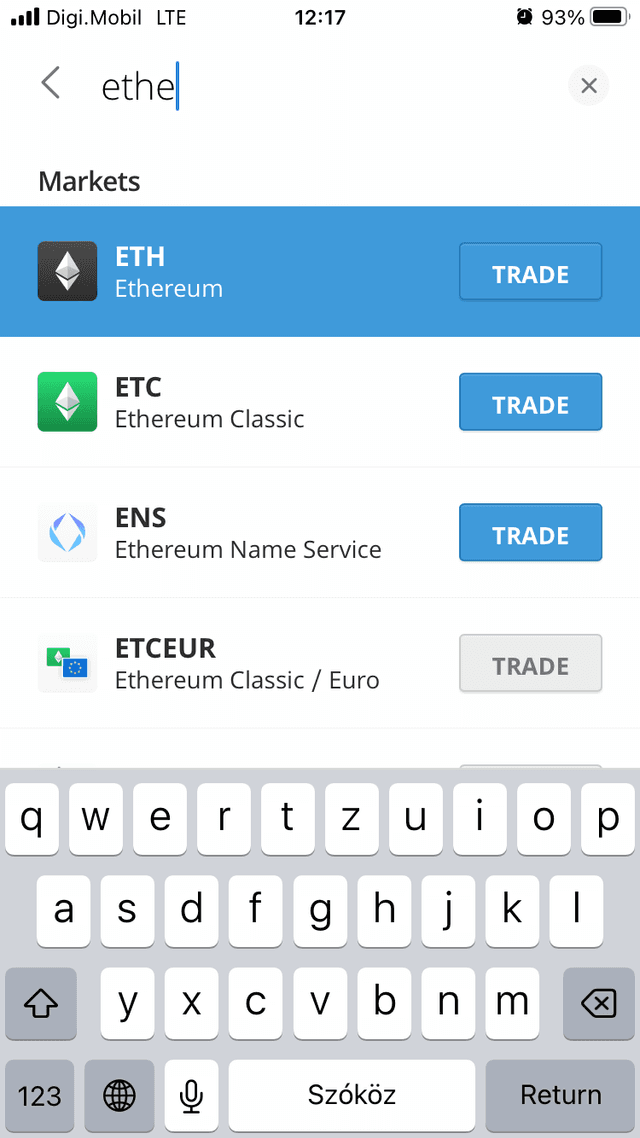

- 80+ cryptocurrencies with MICA license

- Regulated by FCA, CySEC, ASIC, SEC/FINRA

- Smart Portfolios (themed investment baskets)

- Real stock and crypto ownership

- eToro Club with VIP benefits

Founded

2007

Headquarters

Tel Aviv, Israel

Clients

35+ million registered

Why choose eToro USA

eToro is the world's leading social trading and investing platform, pioneering copy trading since 2007. With over 35 million registered users across 100+ countries, eToro offers a unique ecosystem combining social networking with multi-asset investing. The platform features real stock ownership, commission-free ETF trading (in many regions), 80+ cryptocurrencies, and the revolutionary CopyTrader™ technology that allows users to automatically replicate top investors' trades. Regulated by FCA (UK), CySEC (Cyprus/EU), ASIC (Australia), and SEC/FINRA (US), eToro provides strong investor protection. In 2025, eToro obtained a MICA crypto license and expanded CopyTrader to US clients. The platform is best suited for social traders, passive investors, and those seeking commission-free stocks and ETFs.

Pros

- Pioneering social trading platform

- CopyTrader for passive investing

- Real stock and ETF trading

- 80+ cryptocurrencies

- User-friendly platform

- Strong social community

Cons

- $5 withdrawal fee

- $10/month inactivity fee after 12 months

- Higher spreads on forex/CFDs

- Currency conversion fees for non-USD