Trust Score: 4.9/100

Based on regulatory status, company history, and financial transparency

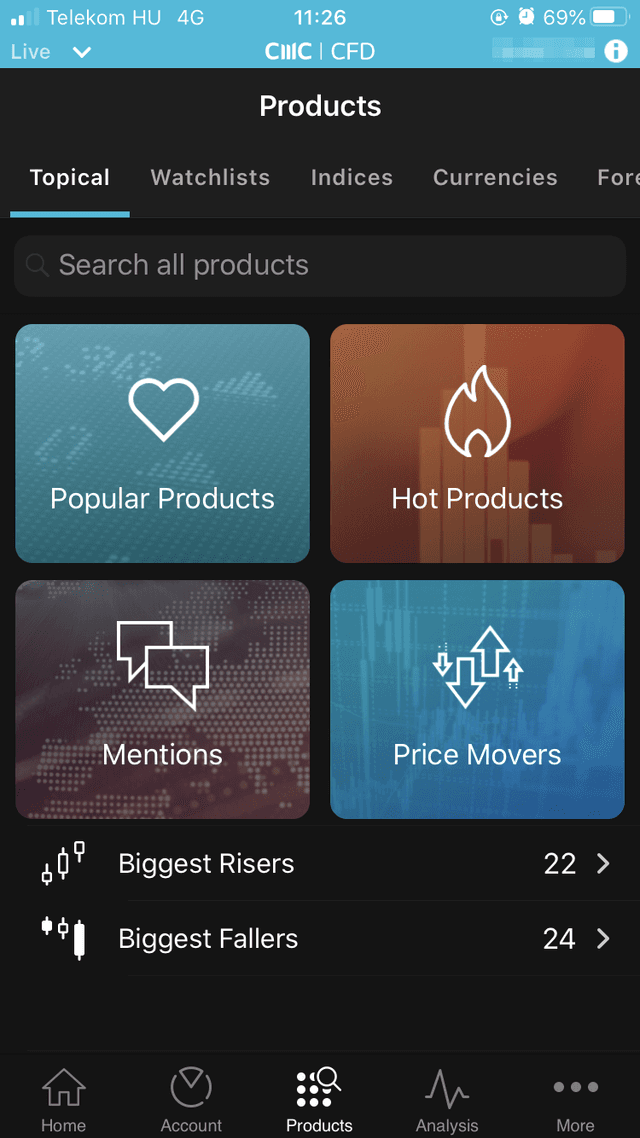

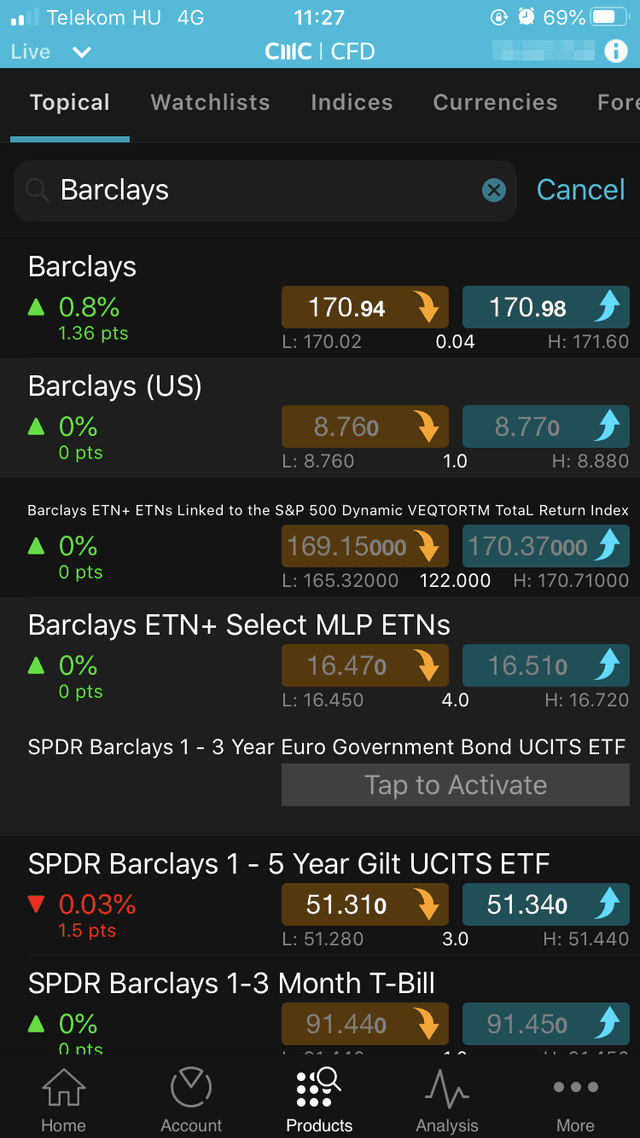

- 12,000+ Instruments

- Next Gen Platform (Award Winning)

- London Listed (FTSE 250)

- Web3 & DeFi innovation (2026)

- Partnership with Westpac

Founded

1989

Headquarters

London, UK

Stock Symbol

CMCX

Clients

300,000+

Why choose CMC Markets

CMC Markets is a FTSE 250 company offering a massive range of instruments and a sophisticated proprietary platform. In 2026, it is pushing boundaries with new 'Financial Super App' features and Web3 integration.

Pros

- Publicly traded & highly regulated

- Huge asset selection (12k+)

- Advanced platform features (NextGen)

Cons

- High stock CFD fees for small trades

- Data fees for some exchanges

CMC Markets

Save Wishlist's

Popular choice

Min Deposit: | $0 |

Inactivity Fee: | No |

Regulated: | Yes |