Trust Score: 85/100

Based on regulatory status, company history, and financial transparency

- No minimum deposit on Standard and Pro accounts

- Regulated by ASIC, FCA, DFSA, FMA (multi-jurisdiction)

- Axi Select - capital allocation for talented traders up to $1M

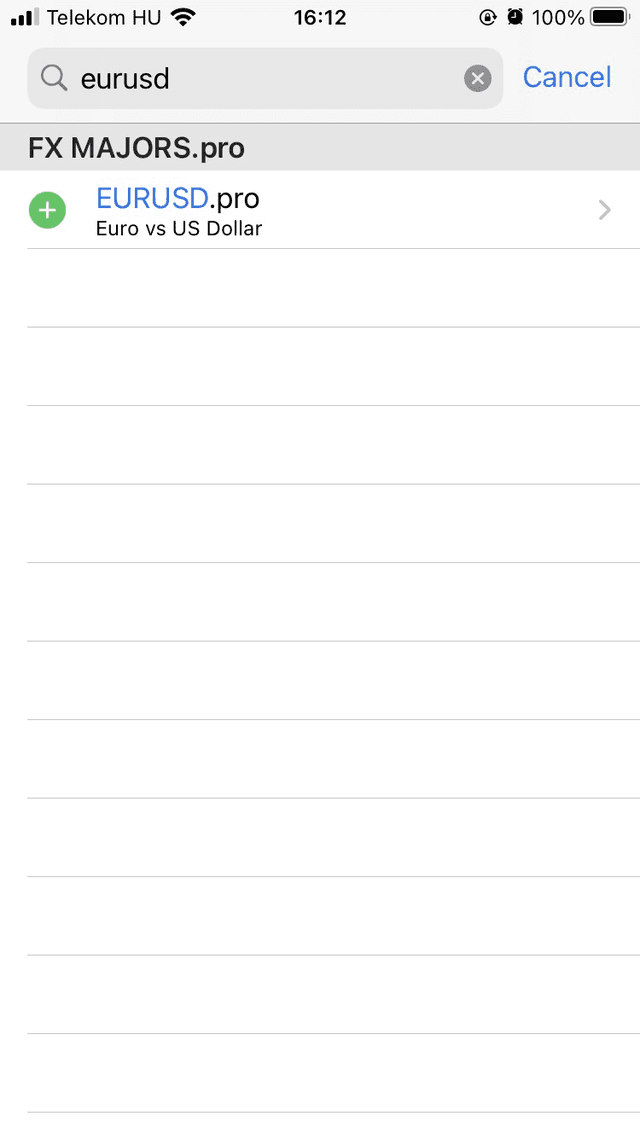

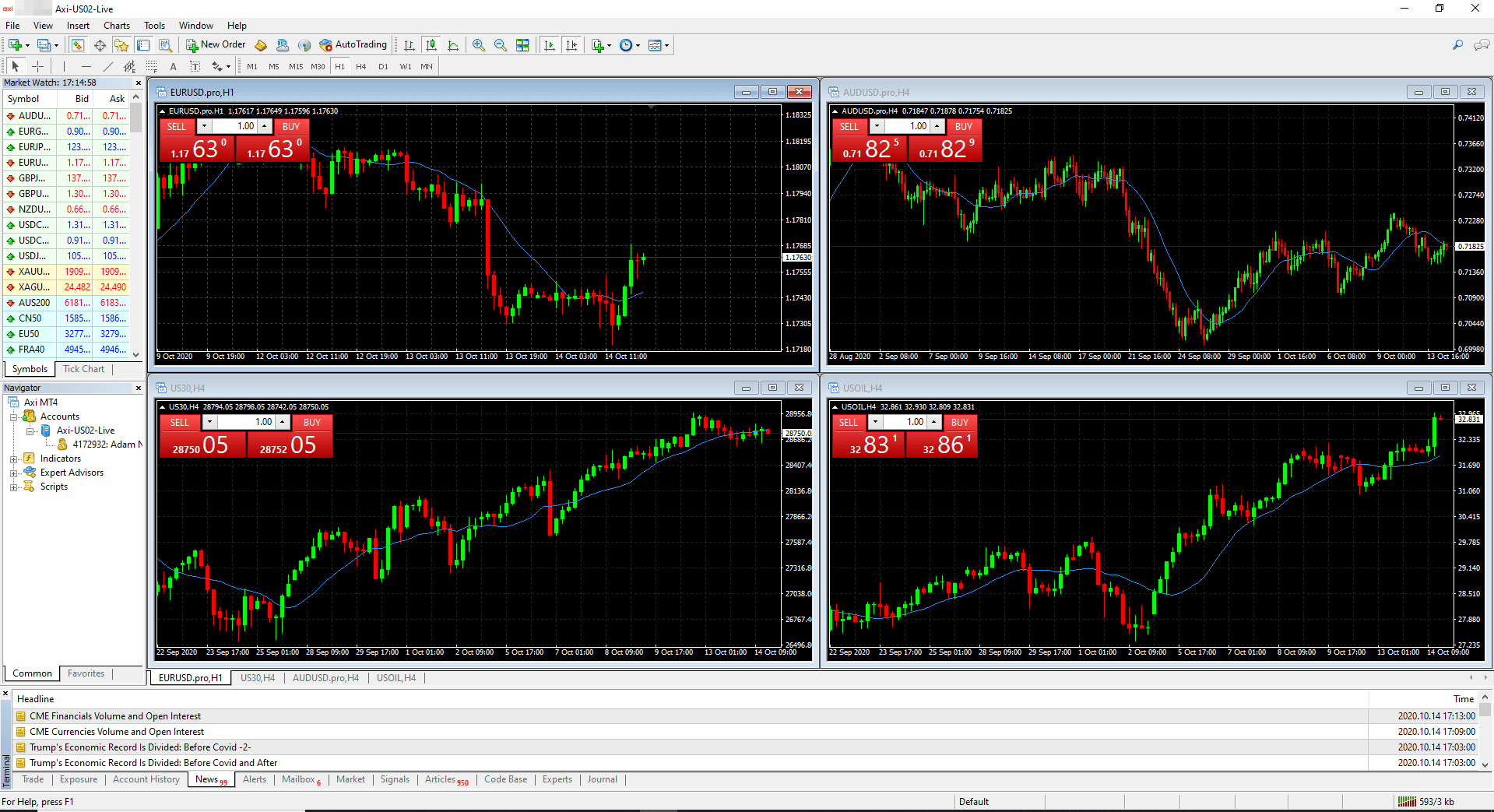

- MT4 + MT5 (2024) + Axi Trading Platform with TradingView

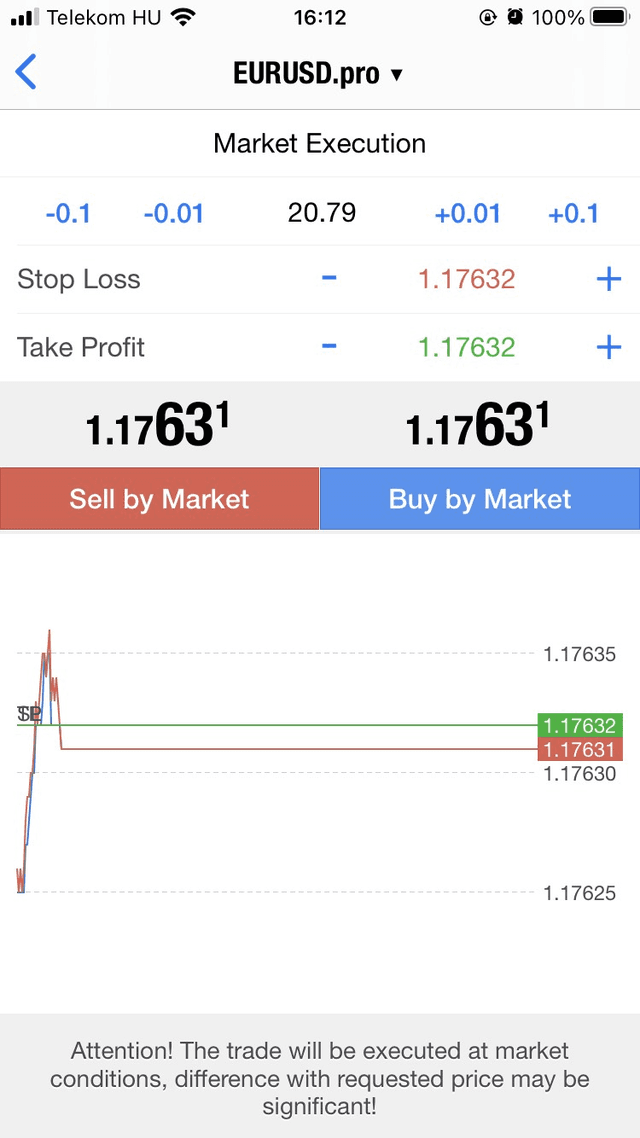

- Raw spreads from 0.0 pips on Pro account ($7 RT commission)

- Elite account: $3.50 commission per lot for high-volume traders

- Free VPS hosting for qualifying traders

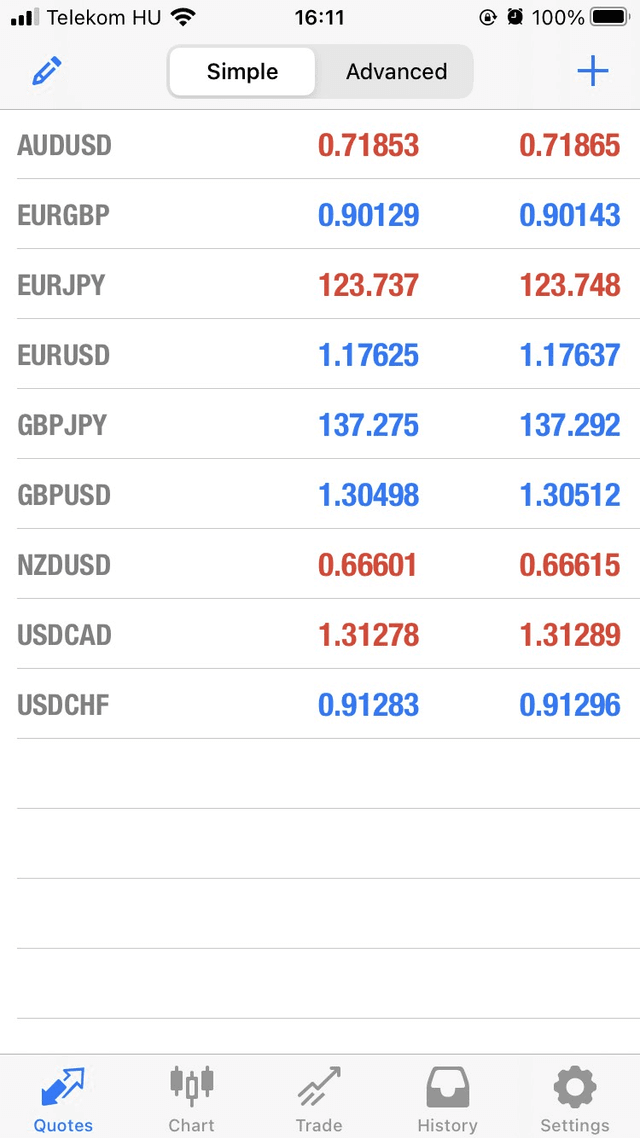

- 70+ forex pairs, 220+ total instruments

Founded

2007

Headquarters

Sydney, Australia

Clients

60,000+

Why choose Axi

Axi (formerly AxiTrader) is a well-established forex and CFD broker founded in 2007 and headquartered in Sydney, Australia. Regulated by ASIC, FCA, DFSA, and FMA, Axi has built a strong reputation for reliable execution, competitive pricing, and the unique Axi Select program that provides capital allocation to talented traders. The broker offers over 70 currency pairs and 220+ CFD instruments across indices, commodities, stocks, and cryptocurrencies. Axi provides MT4, MT5 (launched in 2024), and the proprietary Axi Trading Platform with TradingView integration. With no minimum deposit requirements on Standard and Pro accounts, Axi is accessible to traders of all levels. The Elite account for high-volume traders ($25,000 minimum) offers reduced commissions of $3.50 per lot. Axi is particularly popular among forex-focused traders and those interested in algorithmic trading with free VPS hosting available.

Pros

- No minimum deposit on Standard and Pro accounts

- Strong ASIC and FCA regulation

- Competitive raw spreads from 0.0 pips

- Axi Select capital allocation program

- Free VPS for qualifying traders

- MT4 + MT5 + proprietary platform options

- Award-winning customer support

Cons

- Inactivity fee after 12 months ($10/month)

- Elite account requires $25,000 minimum

- Limited stock CFD selection compared to competitors

- No ETFs available