Trust Score: 93/100

Based on regulatory status, company history, and financial transparency

- Regulated across 9 jurisdictions on 6 continents

- Commission-free trading with fixed spreads

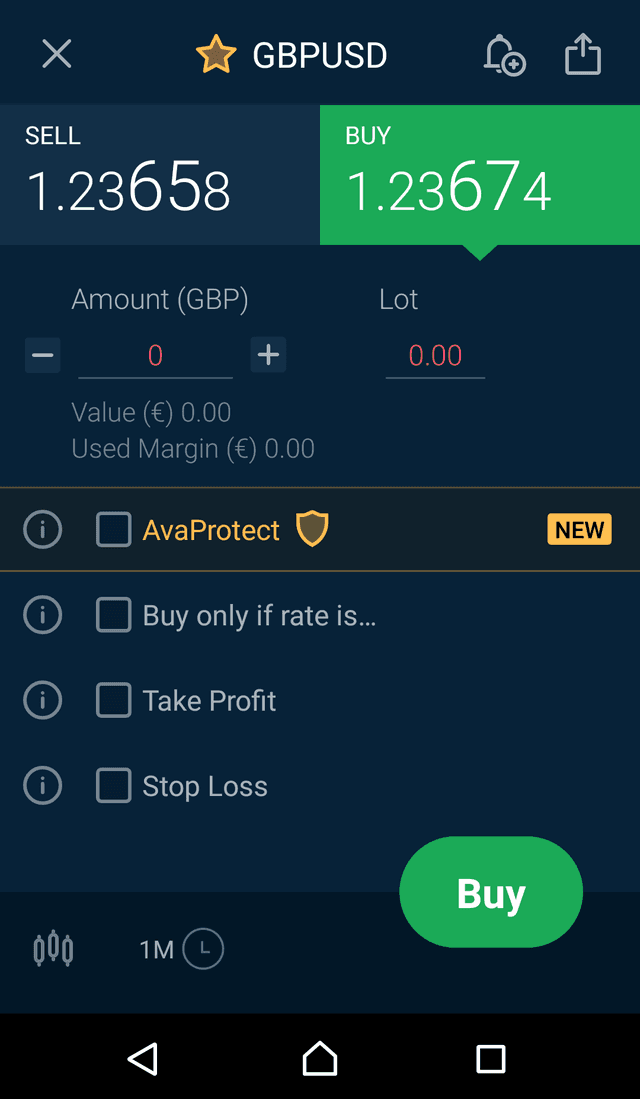

- AvaProtect - unique paid loss protection tool

- AvaOptions - dedicated forex options platform

- AvaFutures - exchange-traded futures (2026)

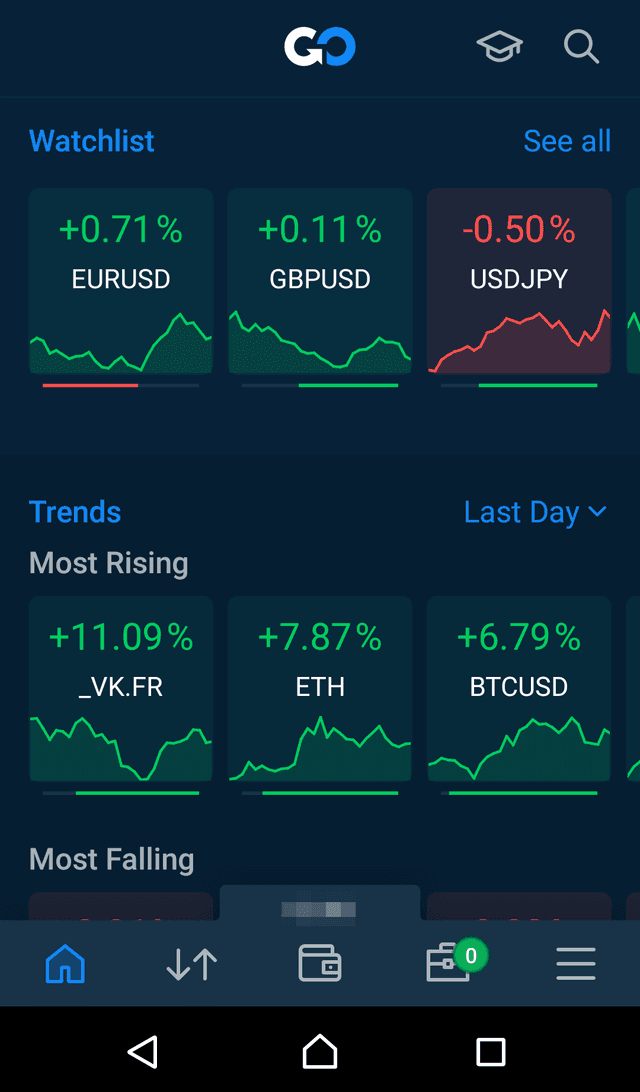

- Award-winning AvaTradeGO mobile app

- Trading Central and AutoChartist integration

- Over 400,000 clients globally

Founded

2006

Headquarters

Dublin, Ireland

Clients

400,000+

Why choose AvaTrade

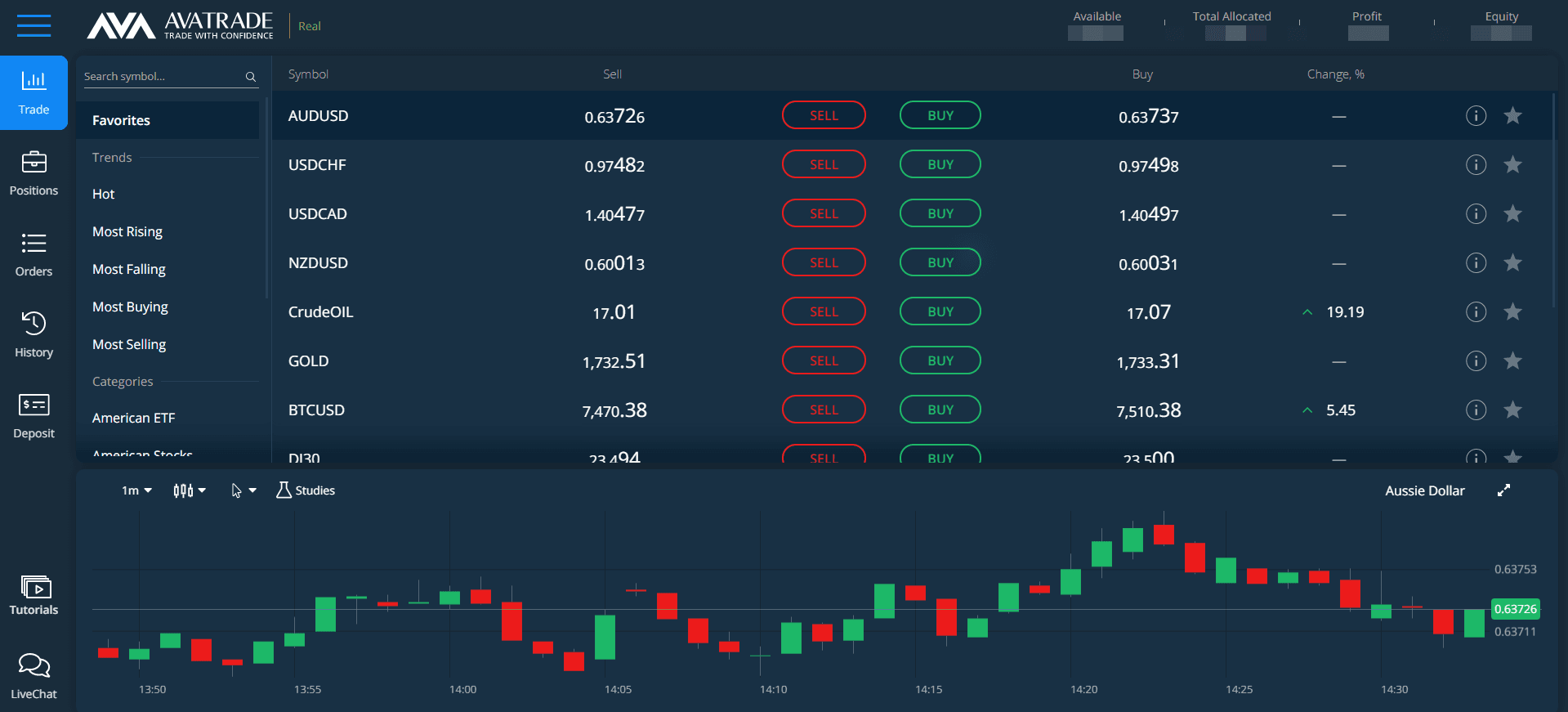

AvaTrade is a globally recognized forex and CFD broker founded in 2006 and headquartered in Dublin, Ireland. With regulation across 9 jurisdictions on 6 continents, AvaTrade is one of the most heavily regulated brokers in the industry, serving over 400,000 clients worldwide. The broker stands out for its commission-free trading model with fixed spreads, innovative risk management tools like AvaProtect (paid loss protection), and a diverse platform selection including MT4, MT5, AvaOptions for vanilla options trading, and the award-winning AvaTradeGO mobile app. AvaTrade's AvaAcademy provides comprehensive educational resources for traders of all levels. In 2026, AvaTrade continues to expand with AvaFutures for exchange-traded futures and enhanced copy trading via AvaSocial, ZuluTrade, and DupliTrade integrations. The broker is best suited for traders who value regulatory safety, platform variety, and transparent fixed spreads over the absolute lowest costs.

Pros

- One of the most regulated brokers globally (9 licenses)

- Commission-free trading model

- Fixed spreads - predictable costs

- Unique AvaProtect risk management tool

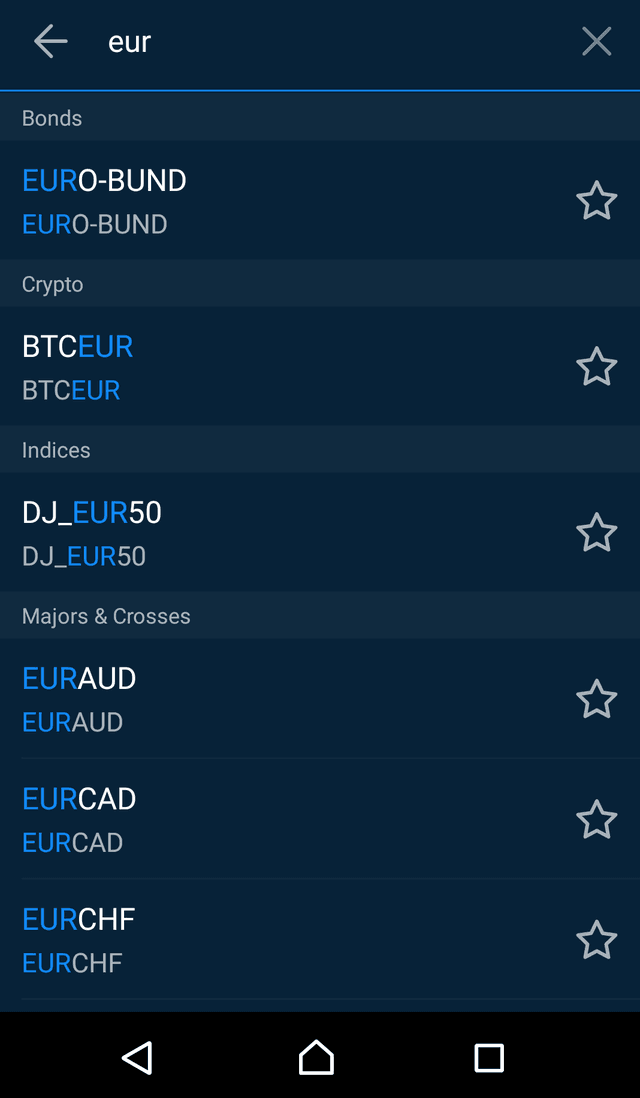

- Excellent platform variety including options

- Strong educational resources via AvaAcademy

- Free deposits and withdrawals

Cons

- Fixed spreads are wider than ECN/Raw spread brokers

- Higher inactivity fee ($50/quarter after 3 months)

- No ECN or raw spread account option

- Cryptocurrency spreads can be high

- $100 minimum deposit